GOODBYE TENSION… HELLO PENSION!

After years of hard work and dedicated service, you want for your transition to retirement to be as seamless as possible.

Here are a few quick tips for making the pension process as easy as 1… 2… 3…

Step 1: Visit your HR Department

It is important to visit your HR Department at least two (2) years before your expected date of retirement. This enables you to ensure that all information required by the Ministry of Finance and the Public Service is already in your HRD’s possession. You should also gather all the information you can about the pension process as well as the emoluments that will be used in the calculation of your pension allotments. It is also crucial to ensure that your name corresponds on all your relevant documents, such as: service records, TRN, bank account and Government Issued photographic identification.

For example: If your name on your TRN card is Jennifer Brown, and the name on your photo ID card is Jennifer Brown-Green, this inconsistency may cause delays in the processing of your payment.

Step 2: Await your award letter from the MoFPS

Once your documents have been submitted to the MoFPS, you can expect an award letter within the next six (6) months. The award letter will indicate the type of pension you have elected to receive (pension or reduced reduced) as well as your gratuity payment amount.

*Presently, it is common for a pensioner to receive two (2) letters, one stating their alimentary allowance and advance payments, the next stating their pension and gratuity amount.

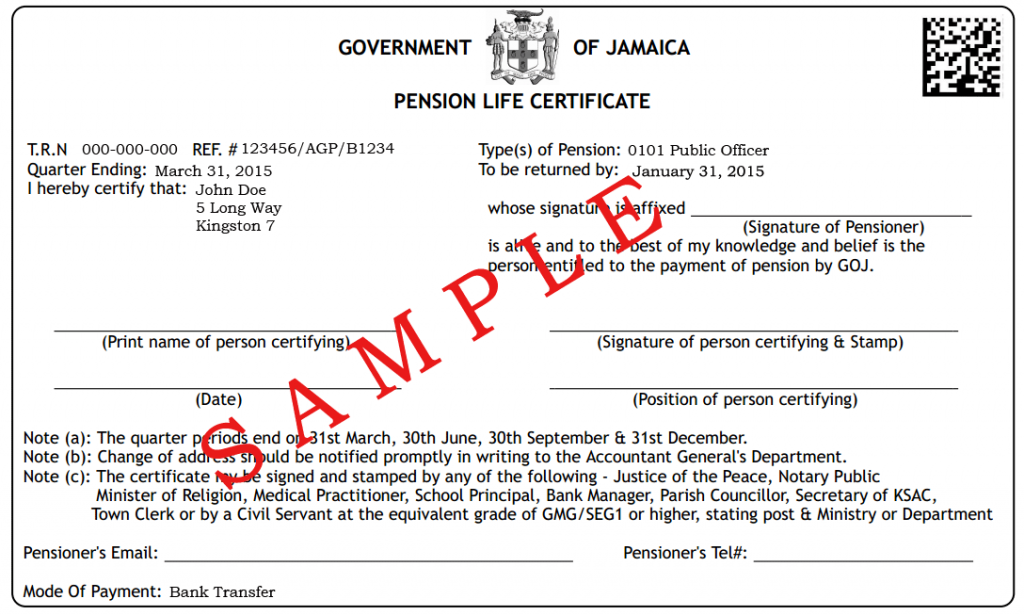

With your letter, you should also receive a copy of the Accountant General’s Department’s Banking Information Form. This form is to be completed, duly notarized and returned along with a bank account verification document (status letter, printout or statement).

Step 3: Check your Account!

If you have submitted all this information to the AGD, you may expect payment in your account within the next two (2) to three (3) pay cycles.