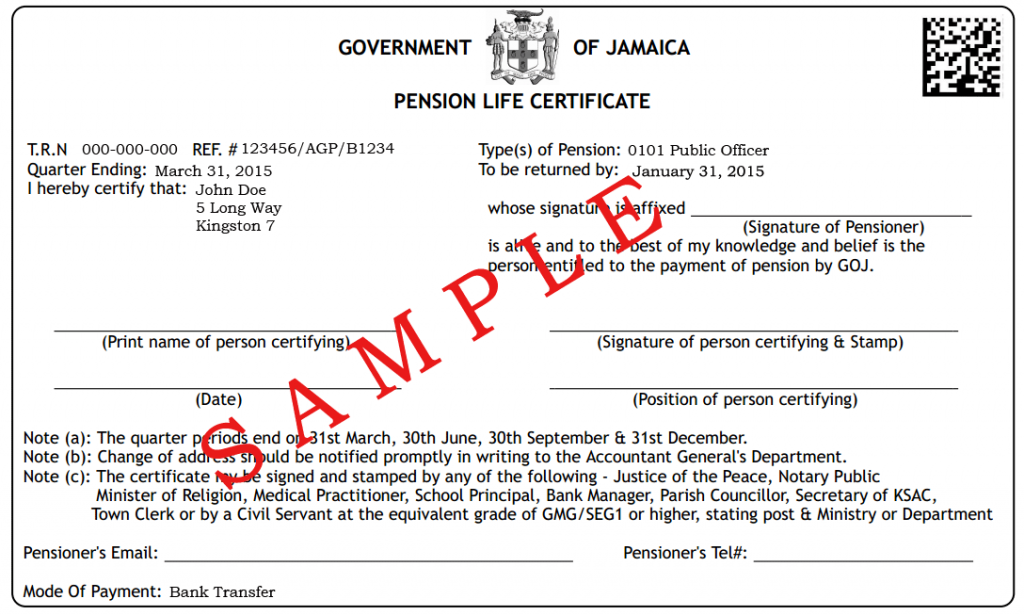

Life Certificates are essential to the pension payment process. The Life Certificate is an official document used to verify that a pensioner is still alive and; therefore, eligible to receive a pension from the Government of Jamaica.

The Accountant General’s Department sends a Life Certificate to each pensioner at the end of every quarter. Certificates are to be completed by pensioners and submitted to the department by the end of the first month of the following quarter.

For example, the Life Certificate sent to you at the end of June, is due for submission to the Accountant General’s Department on or before July 31.

- You must sign your Life Certificate and ensure that the person certifying indicates the date of signing. If, at the point of submission, the date on your Life Certificate exceeds three months it will be considered invalid.

- The person certifying the Certificate must affix their stamp or seal.

- If a civil servant is certifying the Certificate and they do not have access to a stamp, please ensure that they state the Ministry, Department or Agency to which they are employed as well as their post and rank.

- The Life Certificates are designed with special security features and are only valid for the quarter for which they are generated. Hence, ensure that the quarter ending date corresponds with the quarter for which you are submitting same.

- Do not alter the information on the face of the Life Certificate. The barcoded Life Certificate has special features unique to you and the specific quarter.

Any of the below listed officers may certify the Life Certificate:

Justice of the Peace, Notary Public, Minister of Religion, Medical Practitioner, Principal, Civil Servant at the rank of GMG/SEG1 and above, Bank Manager, Parish Council, Secretary of the KSAC and Town Clerk.

Points to note:

- The Certificate cannot be certified by a family member.

- Civil Servants who have retired from the public service and hold no other office, listed as being eligible to sign, are not able to certify the Certificate.

The completed Life Certificate ought to be submitted to the Accountant General’s Department either by post or hand delivery.

If a pensioner does not submit a life certificate, is late in submitting the certificate, or if the life certificate submitted is invalid, payments may be suspended until a valid life certificate is received.