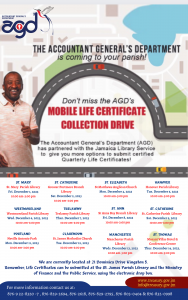

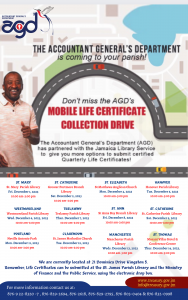

Government Pensioners! The Life Certificate Mobile Drive is back from December 1-14, and is coming to your parish! See poster for details.

Government Pensioners! The Life Certificate Mobile Drive is back from December 1-14, and is coming to your parish! See poster for details.

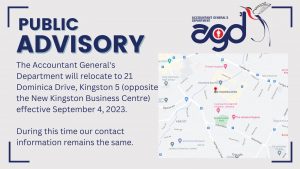

The Accountant General’s Department will relocate to 21 Dominica Drive, Kingston 5 (opposite the New Kingston Business Centre) effective September 4, 2023.

During this time our contact information remains the same.

Let’s join hands and spread awareness to help others.

Dear Valued Stakeholder,

We wish you a very happy holiday filled with love, light and warmth. Spend this special time with your family, friends and loved ones.

Thank you for a tremendous year, we look forward to your continued support in 2022.

Merry Christmas and a Happy New Year from all of us at the Accountant General’s Department.

Kind regards,

Anya Jones, Accountant General

Government Pensioners!

Life certificate submission is simpler than ever.

The Accountant General’s Department Mobile Life Certificate Collection Unit is coming to you in time for the holidays!

Meet us at you local library from Monday, December 6 to Tuesday, December 14, 2021.

December 6

St Thomas Parish Library P.O. Box 13, Morant Bay | 9:00 a.m. -11:00 a.m.

Portland Parish Library, Port Antonio | 2:00 p.m. – 4:00 p.m.

December 7

Ocho Rios Branch Library, Ocho Rios | 10:00 p.m- 3:00 p.m.

December 8

Hanover Parish Library, Lucea | 10:00 p.m- 3:00 p.m.

December 9

Westmoreland Parish Library, Sav-La-Mar | 10:00 p.m- 3:00 p.m.

December 10

Clarendon Parish Library, May Pen | 10:00 p.m- 3:00 p.m.

December 11

St. Catherine Parish Library, # 1 Red Church Street, Spanish Town | 9:00 p.m- 3:00 p.m.

Greater Portmore Branch Library, The Civic Centre, 1 West Henderson Blvd., Portmore | 2:00 p.m.-5:00 p.m.

December 13

Manchester Parish Library, 34 Hargreaves Avenue, Mandeville | 10:00 p.m- 3:00 p.m.

December 14

St Elizabeth Parish Library, 64 High Street Black River, St. Elizabeth | 10:00 p.m- 3:00 p.m.

Come and

Visit our website at www.treasury.gov.jm for more details

Give us a call at (876) 922-8320 or send us an email at info@treasury.gov.jm

The Accountant General’s Department, Improving non- stop!

Life Certificates for the July- September Quarter are now available and due by July 31, 2021.

Don’t Delay, Submit today!

Dear Valued Customers,

In observance of the new Covid-19 measures announced by Prime Minister Andrew Holness, our customer service office will close at 11: 30 a.m. on Friday, March 26, 2021. We apologize for any inconvenience this may cause.

The Accountant General’s Department is grateful for your understanding and wishes all to stay safe during this time.

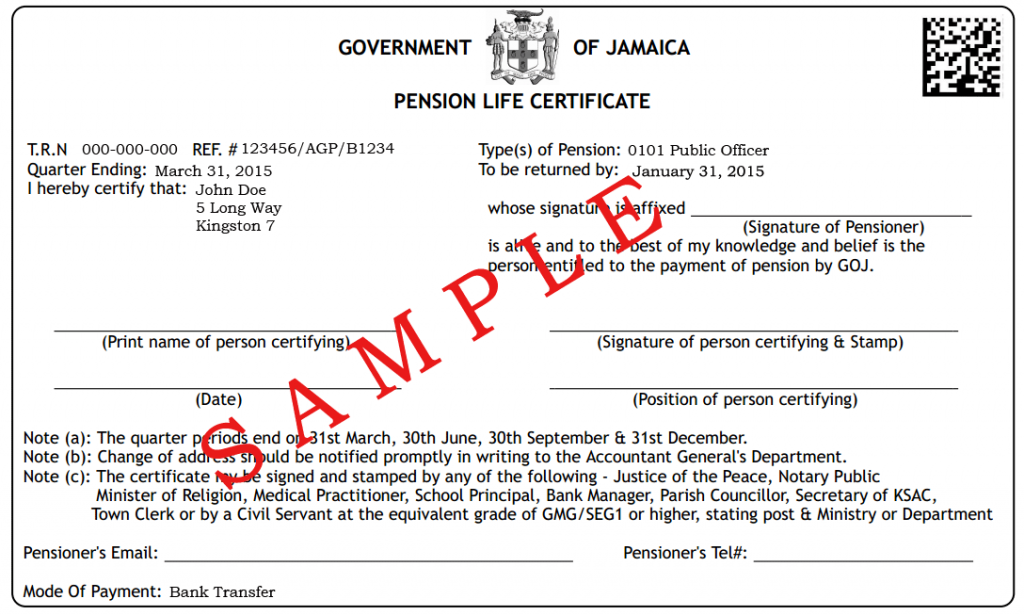

A Life Certificate is an official document used by the Accountant General’s Department to verify the living status of a pensioner and tells us that you are eligible for payments from Government of Jamaica.

Here are a few FAQs and Answers regarding the Certificate and the processes associated with it.

Q: How often are certificates due?

A: Pensioners are required to submit a Life Certificate once every quarter. The due dates for the certificate are as follows: January 31, April 30, July 31, and October 31.

Q: Who is able to certify my Life Certificate?

A: The certificate may be stamped and signed by any of the following: Justice of the Peace, Notary Public, Minister of Religion, Medical Practitioner, School Principal, Bank Manager, Parish Councillor, Secretary of KSAC, Town Clerk or a civil servant at the equivalent grade of GMG/SEG1 or higher, stating post and Ministry or Department.

NB: The Life Certificate must not be signed by a family member or anyone residing in the same household as the pensioner.

Q: Am I able to submit a scanned/faxed of my Life Certificate?

A: No. The Life Certificate must be submitted carrying the original signatures of the certifier and pensioner as a hardcopy document. Accepted modes of submission are, post and delivery.

Q: What if I am unable to sign the certificate for medical reasons?

A: If, for a medical reason, you are unable to sign your Life Certificate, the procedure for completion of the certificate is as follows:

Q: If I am paid through the Consulate/ High Commission, do I need to submit Life Certificates to the Accountant General’s Department?

A: No. All communication should be had with the Consul General/ High Commissioner in the country/state of residence.

Q: If I alter the date on the Life Certificate, will it be accepted for the date period that I have written on?

A: No. Life Certificates are barcoded with the dates ingrained therein.

Q: What do I do if I don’t receive my Life Certificate in the mail/e-mail?

A: You may contact the Department to request a certificate in any of the following ways:

| Live Chat | https://www.treasury.gov.jm |

| https://www.facebook.com/thetreasuryja | |

| https://www.instagram.com/thetreasuryja | |

| https://twitter.com/thetreasuryja | |

| Whatsapp (Text only) | 1-876-818-6583 |

| info@treasury.gov.jm |