Early Pay Dates for December 2020 and January 2021

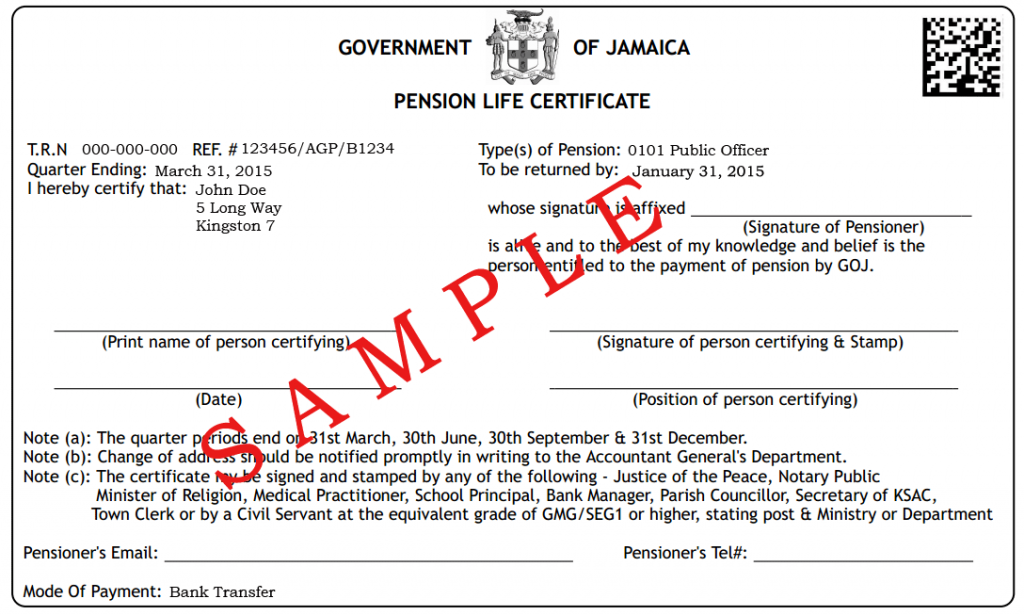

A Life Certificate is an official document used by the Accountant General’s Department to verify the living status of a pensioner and tells us that you are eligible for payments from Government of Jamaica.

Here are a few FAQs and Answers regarding the Certificate and the processes associated with it.

Q: How often are certificates due?

A: Pensioners are required to submit a Life Certificate once every quarter. The due dates for the certificate are as follows: January 31, April 30, July 31, and October 31.

Q: Who is able to certify my Life Certificate?

A: The certificate may be stamped and signed by any of the following: Justice of the Peace, Notary Public, Minister of Religion, Medical Practitioner, School Principal, Bank Manager, Parish Councillor, Secretary of KSAC, Town Clerk or a civil servant at the equivalent grade of GMG/SEG1 or higher, stating post and Ministry or Department.

NB: The Life Certificate must not be signed by a family member or anyone residing in the same household as the pensioner.

Q: Am I able to submit a scanned/faxed of my Life Certificate?

A: No. The Life Certificate must be submitted carrying the original signatures of the certifier and pensioner as a hardcopy document. Accepted modes of submission are, post and delivery.

Q: What if I am unable to sign the certificate for medical reasons?

A: If, for a medical reason, you are unable to sign your Life Certificate, the procedure for completion of the certificate is as follows:

Q: If I am paid through the Consulate/ High Commission, do I need to submit Life Certificates to the Accountant General’s Department?

A: No. All communication should be had with the Consul General/ High Commissioner in the country/state of residence.

Q: If I alter the date on the Life Certificate, will it be accepted for the date period that I have written on?

A: No. Life Certificates are barcoded with the dates ingrained therein.

Q: What do I do if I don’t receive my Life Certificate in the mail/e-mail?

A: You may contact the Department to request a certificate in any of the following ways:

| Live Chat | https://www.treasury.gov.jm |

| https://www.facebook.com/thetreasuryja | |

| https://www.instagram.com/thetreasuryja | |

| https://twitter.com/thetreasuryja | |

| Whatsapp (Text only) | 1-876-818-6583 |

| info@treasury.gov.jm |

Pensioners are required by law to pay income tax.

Once the pension is over the tax threshold then a 25 percent income tax is applied. However the tax threshold varies depending on the age of the pensioner.

See below the break down of the tax thresholds for pensioners within the specified age ranges.

The tax threshold or tax free pay that is applicable as at April 1, 2017 is as follows:

Therefore, any amount exceeding the stipulated tax threshold mentioned will attract 25% income tax.

NB: All amounts mentioned are the current rates and are subject to change by the Government of Jamaica.

Pensioners retired prior to April 1, 2018 who elected to take a gratuity at retirement and have completed 12 ½ years in retirement will be restored to full pension.

When a pensioner elects to receive a gratuity and a reduced pension, a quarter of the pension for 12 ½ years is used to pay the Gratuity. At the end of the 12 ½ years the ¼ pension that was used to pay the gratuity, is restored to the pensioner, pending that his date of retirement is before April 1, 2018.

The pensioner would have already received the ¼ pension in the gratuity, therefore the restoration payment will be effective as at the end of the 12 ½ years. It is not paid retroactively neither is it a lump sum.

Please note that basic pension refers to the amount paid at the date of retirement. Any increase thereafter is referred to as temporary supplement.

Government Pensioners are entitled to receive a minimum pension each year based on their years of service.

The Government of Jamaica stipulates the minimum pension, which is subject to change.

The current minimum pension, with effect from July 1, 2019, is outlined as follows:

Pensioners under the age of 55, who were not retired on the grounds of ill health or did not complete 10 years of service are paid the amount set out in their pension award letter.

GOODBYE TENSION… HELLO PENSION!

After years of hard work and dedicated service, you want for your transition to retirement to be as seamless as possible.

Here are a few quick tips for making the pension process as easy as 1… 2… 3…

Step 1: Visit your HR Department

It is important to visit your HR Department at least two (2) years before your expected date of retirement. This enables you to ensure that all information required by the Ministry of Finance and the Public Service is already in your HRD’s possession. You should also gather all the information you can about the pension process as well as the emoluments that will be used in the calculation of your pension allotments. It is also crucial to ensure that your name corresponds on all your relevant documents, such as: service records, TRN, bank account and Government Issued photographic identification.

For example: If your name on your TRN card is Jennifer Brown, and the name on your photo ID card is Jennifer Brown-Green, this inconsistency may cause delays in the processing of your payment.

Step 2: Await your award letter from the MoFPS

Once your documents have been submitted to the MoFPS, you can expect an award letter within the next six (6) months. The award letter will indicate the type of pension you have elected to receive (pension or reduced reduced) as well as your gratuity payment amount.

*Presently, it is common for a pensioner to receive two (2) letters, one stating their alimentary allowance and advance payments, the next stating their pension and gratuity amount.

With your letter, you should also receive a copy of the Accountant General’s Department’s Banking Information Form. This form is to be completed, duly notarized and returned along with a bank account verification document (status letter, printout or statement).

Step 3: Check your Account!

If you have submitted all this information to the AGD, you may expect payment in your account within the next two (2) to three (3) pay cycles.